Let’s Talk… The 2026-27 California Budget Proposal

A snapshot of Governor Newsom’s Budget and NextGen’s priorities

January 27, 2026

Like the cliff swallows returning to San Juan Capistrano or Yosemite’s scenic firefall event, the January release of the Governor’s California state budget proposal is an annual occurrence that is eagerly anticipated by (at least some) residents throughout the state. As the opening act of California’s budget adoption process, the Governor’s January budget raises the curtain on how the executive branch proposes to allocate hundreds of billions of dollars of public funds each year.

A prior edition of NextGen’s Let’s Talk blog provided an overview of how January budget proposals work, where to find sources of information that can help in understanding budget proposals, and when and how to engage with policymakers in the monthslong process of reviewing and refining various elements of the state budget. This blog post looks more specifically at the 2026-27 budget proposal that was released by the Governor earlier this month and discusses a few priority areas of importance to NextGen in the year ahead.

2026-27 January Budget Proposal Overview

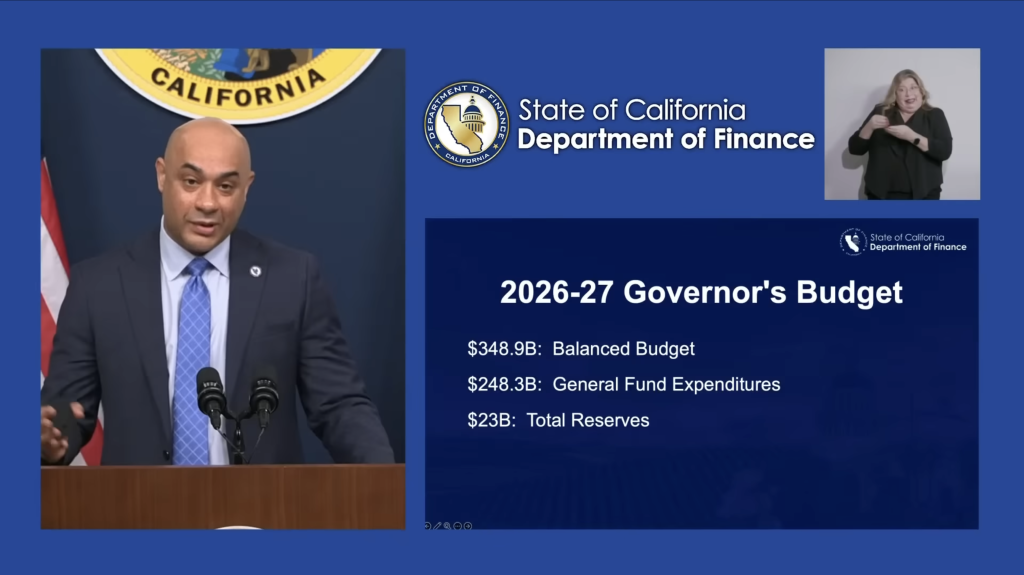

This year’s proposal from Governor Newsom, which will be his final January budget before he leaves office next year, anticipates a small deficit in the 2026-27 fiscal year, with larger deficits projected in later years. The Governor’s January proposal is based on General Fund revenue projections that are $42 billion higher than previous budget estimates over the three-year period that encompasses the prior budget year (2024-25), the current budget year, (2025-26), and the upcoming budget year (2026-27). Due to spending obligations that are directly tied to higher revenues, these additional revenues will largely be offset by corresponding spending, resulting in a projected $2.9 billion shortfall in 2026-27.

The Governor’s budget proposal also reflects projected long-term structural deficits, with a $22 billion shortfall anticipated in 2027-28 and similar gaps between revenues expenditures in subsequent years. Noting that the January budget “is a beginning” and “not the final word,” the Governor expressed his Administration’s intent to revise the proposal in May to produce a plan for balancing the state budget over both the 2026-27 and 2027-28 fiscal years, while adequately funding reserves and reflecting updated revenue and spending projections. However, the current proposal provides no details about how that multi-year goal will be achieved.

The January proposal includes some discretionary measures that close the estimated $2.9 billion shortfall. The bulk of the difference is closed by a proposal to suspend a $2.8 billion deposit to the state’s budget reserve. Rather than setting aside these funds, the budget proposes to make them available for General Fund spending in 2026-27. Also contributing substantially to bringing the Governor’s budget into balance is a proposal to defer the payment of a $5.6 billion addition to the state’s education spending obligations for the 2025-26 fiscal year until the 2027-28 fiscal year.

Comparison With Legislative Analyst’s Office Projections

A useful strategy for analyzing the Governor’s budget proposal involves comparing it to the fiscal outlook and budget responses prepared by the Legislative Analyst’s Office.

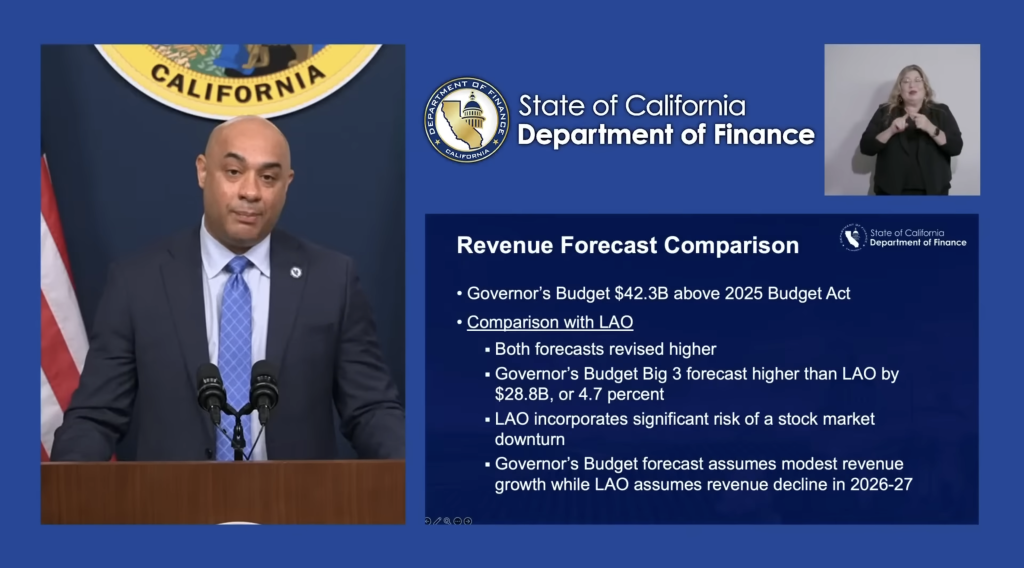

The LAO’s November 2024 fiscal outlook projected a budget problem of roughly $18 billion, which is about six times larger than the deficit cited in the Governor’s budget. The Governor’s budget projects revenues will be more than $30 billion higher than the LAO’s outlook and, relatedly, anticipates substantially higher spending than the LAO projected.

The large differences in this year’s budget projections produced by the LAO and the Department of Finance (DOF) primarily reflect different underlying assumptions about the likelihood of an economic downturn during the coming fiscal year. While the resulting numerical differences are large, those differences can tend to overshadow several important areas of agreement between the LAO and the Administration. Both budget outlooks recognize that the state has returned to a pattern of structural deficits and identify the state’s disproportionate reliance on revenues from volatile AI-related investment activity as a near-term threat to the state’s fiscal stability. And both the LAO and the Administration assert the importance of taking near-term action to prevent further deterioration of the state’s long-term fiscal outlook.

Perhaps the most notable difference between the LAO’s budget recommendations and the Governor’s proposal is the emphasis that the LAO places on adopting immediate and substantive solutions to the state’s structural budget imbalances. The LAO notes that the long-term structural state deficits over the past few years have coincided with a period of economic expansion and revenue growth, unlike in some previous budget cycles in which structural deficits were driven by economic downturns and related drops in revenues. This raises concerns that, absent immediate steps to close the structural deficit, the state will be in a poor position to stabilize its budget when the next recession truly challenges state finances.

The Governor’s proposal cites the importance of “preparing for storms before they arrive,” however, the LAO raises concerns that the January budget does not go far enough to materially address the challenges facing budget policymakers. A key focus of this year’s budget development process will involve navigating the very real tension between (1) making near-term budget adjustments that will improve the state’s future fiscal resilience and(2) minimizing the harm that can result from deep funding cuts to vital programs.

The 2026-27 Budget and NextGen’s Priorities

The Governor’s January proposal represents what his Administration has called a “workload” budget, containing relatively few significant changes to spending or revenue policies compared to the current budget. Unlike in past years, the budget doesn’t contain proposals for substantial new investments in many policy areas. For example, despite ongoing concerns about the role that housing costs play in driving the affordability challenges that confront most Californians, the January budget supports some administrative restructuring of state affordable housing programs without any additional General Fund investments in affordable housing.

However, despite the Administration’s efforts to present a budget without major new proposals, within the roughly $600 million in new spending proposals that the Legislative Analyst’s Office (LAO) has identified in the January budget, there are still several elements that help advance NextGen’s policy priorities.

For example, the proposed budget includes:

- A $24.6 million increase in appropriations for Farm to School Programs that promote access to local sustainable foods for school meals;

- A $100 million investment in kitchen infrastructure and training to support improved school meals; and

- A $14.3 million increase in funding for the Healthy School Foods Pathways program that supports the school food service workforce through apprenticeship and training programs.

All three of the above programs have been priorities for NextGen as a part of its ongoing work on food security and universal school meals.

The January proposal also makes some notable investment in the area of workforce development and apprenticeships, which is another priority for NextGen. Specifically, the proposed budget would make a $100 million one-time investment to implement provisions of the Master Plan for Career Education that would increase high school students’ access to college and career pathways. This would include expanded access to dual enrollment, which allows high school students to take community college classes while still in high school. The Governor also proposed $37 million in additional funding to support the state’s Credit for Prior Learning Initiative. This initiative seeks to support working adults and veterans pursuing college degrees by allowing them to receive credits for skills and knowledge obtained outside of a traditional classroom through experiences like military training and industrial certification programs.

In the area of climate policy, the budget proposal largely maintained funding for state climate programs, while proposing an additional targeted investment of $200 million to incentivize zero-emission vehicle purchases. The ability to preserve funding for the state’s vital investments in climate programs is largely thanks to the availability of funding from the voter-approved climate bond and from the renewal of the state’s cap-and-invest program, which NextGen played a central role in last year.

While much work remains to be done to achieve NextGen’s overall budget goals across the full range of issue areas that we work on, the above examples illustrate that even in a difficult fiscal environment it is possible for the state budget to advance the interests of all Californians in important ways.

Next Steps

With the Governor’s budget proposal officially released and the initial legislative budget committee overview hearings completed, the Legislature will now begin the process of holding budget subcommittee hearings. During these subcommittee hearings, the budget subcommittee members will dig into the details, reviewing and evaluating specific program expenditures and then making specific funding recommendations. This budget development process will take place over the next several months and will include the May Revision which will be released in mid-May. At that time, the Administration will update its revenue forecast, and, in turn, make the necessary funding and expenditure changes to the budget based on these new figures. The final state budget must be passed by the Legislature by June 15th and signed by the Governor by June 30th.

Over the coming months, NextGen will work to ensure that the final state budget enacted in June will meet the fiscal demands of the moment while still protecting the needs and interests of California’s diverse communities.

Thanks for reading,

Brian Weinberger