California passes most comprehensive 'Student Borrower Bill of Rights' of any U.S. state

The California Student Borrower Bill of Rights, or AB 376, was passed by the state’s Senate 23-8 on Friday, creating the country’s most comprehensive legislation enshrining student debt protections.

"We applaud the California state legislature for passing AB 376 and moving one step closer to creating the nation's strongest protections for student loan borrowers,” Natalia Abrams, executive director of Student Debt Crisis, which advocated for the measure, told Yahoo Finance.

The bill now goes to the California Assembly for a concurrence vote before heading to Governor Gavin Newsom, who would then have 30 days to sign or veto the legislation.

"Californians needed robust consumer protections from student loan industry abuses when this bill was introduced over a year ago,” Abrams added. "Now, in the middle of the worst health and economic crisis in generations, the Student Borrower Bill of Rights is needed more than ever.”

AB 376 is designed to establish special protections for student loan borrowers by creating new standards for student loan lenders and servicers, including:

Ban “abusive” student loan servicing practices that take unreasonable advantage of borrowers’ confusion over loan repayment options

Create minimum servicing standards related to application of payments, paperwork retention and specialized staff training

Establish a Student Borrower Ombudsman within the Department of Business Oversight (DBO) responsible for reviewing complaints, gathering data and coordinating with related state agencies

Grant DBO additional “market monitoring” authorities, to collect better data about the student loan servicing industry

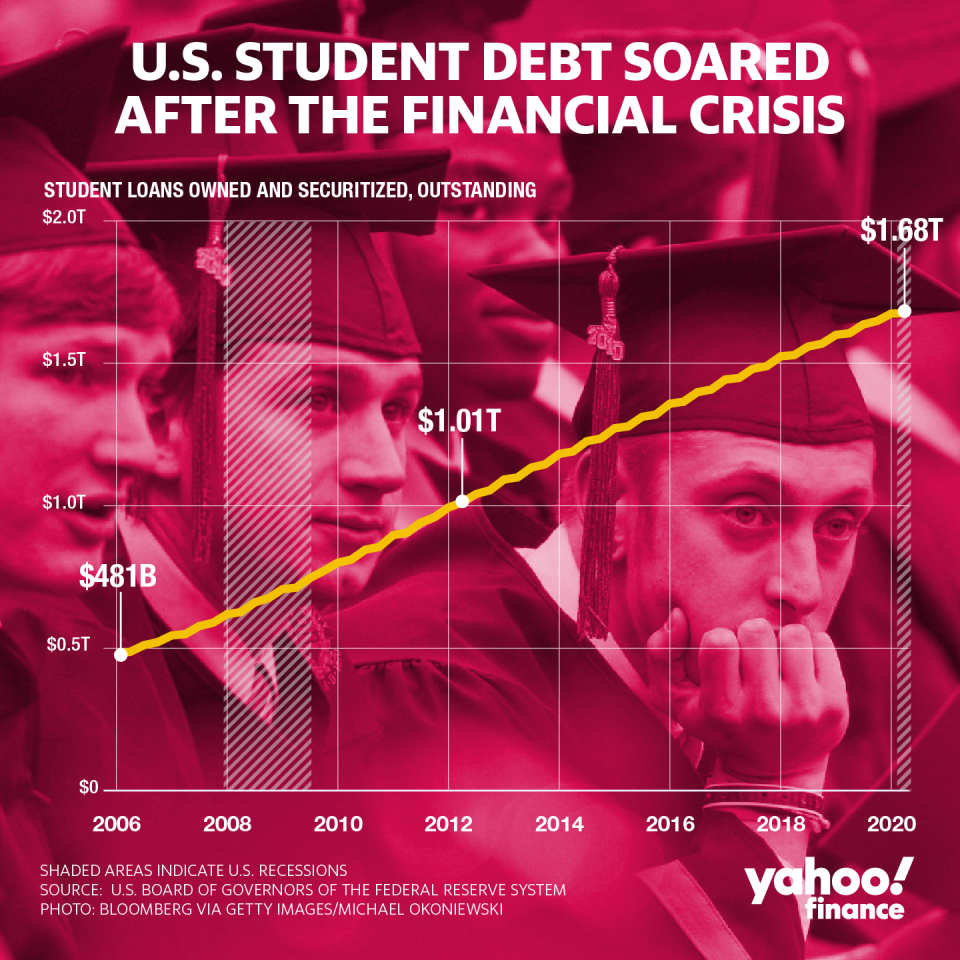

There are 4 million borrowers in California, with an average debt burden of $37,000 creating roughly $147 billion in outstanding loans overall. And while other states have enacted different forms of the same legislation, consumer groups note that California’s proposal is the most comprehensive.

Across the country, Connecticut, Maine, and New York have already passed their own versions of a bill of rights for student loan borrowers. Massachusetts is also pushing for its own student loan bill of rights.

“This is gonna be a game-changer in this area,” Assembly Member Mark Stone, who introduced the legislation in February last year, argued on the floor before the vote. The legislation had been slowly progressing since Yahoo Finance last reported on it in May of last year.

Suzanne Martindale, senior policy council and legislative manager for Western states at Consumer Reports, said in a statement that the new bill of rights “will protect Californians from predatory loan servicing practices and help ensure they stand a fair shot at putting these debts behind them.”

—

Aarthi is a writer for Yahoo Finance. Follow her on Twitter @aarthiswami.

Read more:

California inches closer to unprecedented ‘Student Borrower Bill Of Rights’

Read the latest financial and business news from Yahoo Finance

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, SmartNews, LinkedIn, YouTube, and reddit.